Convenience and Personal Service of an Independent Agent

Name

City

Phone

Type of Insurance Requested

Texas Only

Home, Auto and Business Insurance

Make the right choice with home, auto and business insurance from Sheaner Insurance Agency and experience the Convenience and Personal Service of an Independent Agent.

Make the right choice with home, auto and business insurance from Sheaner Insurance Agency and experience the Convenience and Personal Service of an Independent Agent.

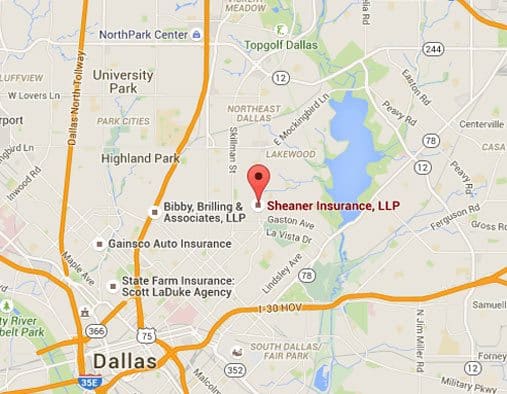

Herbert M Sheaner Jr Insurance Agency offers car, home, flood and business insurance of all kinds. Serving Dallas/Fort Worth and all parts of Texas (TX) since 1952. (reprint August 24, 1952)

We help before you buy to find the best combination of price, coverage, and service for auto, home, and commercial insurance. Call our experienced agents for a quote through one of the many companies we represent.

Read More About Your Agent

Se Habla Español

More Testimonials and Reviews…

Call or Visit our office for a personal review of your existing coverage or browse through the tabs at the top for more informative articles, insurance tips and recommendations or to request a quote. Start in the Car Insurance section to learn more about personal automobile and business insurance for commercial use vehicles. In the Property Insurance area you will find valuable information about Homeowners, Renters and Flood insurance. Look in Business Insurance for Workers Compensation, General Liability and Package policies for retail stores, manufacturing, office and warehouse buildings, apartments, artisan contractors, churches and more. Specialty Programs include Bounce House Rentals, Vendors, Special Events, Sports Camps & Clinics, Automobile Salvage Yards.

Contact us today for a quote

Volunteering for Nonprofit Organizations

Question:

A fellow board member on our local nonprofit organization told board members and other volunteers that they don’t need to buy any special liability insurance, because their homeowners policies will cover them. Is this correct?

Sheaner Insurance Agency August 14th, 2015

Posted In: Articles

Workers Compensation

Volunteers

Question:

Our nonprofit organization depends heavily on the services provided by volunteers. Do any of our insurance policies cover medical expenses if a volunteer is injured on the job? Will our liability policies defend us if a volunteer sues the organization because of the injury? Is the organization covered if we get sued for an accident caused by the volunteer?

Answer:

These are excellent questions. Board members and staff of nonprofit organizations are right to be concerned about taking care of their volunteers and protecting the organization from liability that might arise out of the services provided by the volunteers. We are privileged to serve several organizations such as yours and this question comes up frequently.

Sheaner Insurance Agency August 11th, 2015

Posted In: Business Insurance

What is an umbrella liability policy and why do I need one?

An umbrella liability policy is a relatively inexpensive way to purchase higher liability limits for you and your family, above and beyond the limits provided in homeowners and auto liability policies. In addition, most umbrella policies provide coverage for liability claims not covered by other policies, subject to a small self-insured retention. Umbrella policies got their name because they provide excess limits in increments of $1 million above more than one underlying policy. Any individual or couple seriously concerned about protecting family assets and earning power should consider an umbrella policy. Accidental tragedies resulting in multi-million dollar lawsuits are far too common to rely solely on basic policies.

Call or email for a Personal Umbrella quote or complete an application and fax to (888) 607-7154

This article was prepared and made available to your agent by the Independent Insurance Agents of Texas, which is solely responsible for its content. Please read your insurance policy. If there is any conflict between the information in this article and the actual terms and conditions of your policy, the terms and conditions of your policy will apply. The Independent Insurance Agents of Texas is a non-profit association of more than 1,500 insurance agencies in Texas, dedicated to helping its members succeed, in part by providing technical resources that explain insurance policies sold to their customers.

Sheaner Insurance Agency August 9th, 2015

Posted In: Business Insurance, Personal Insurance

Taking Insurance to College

Question:

My son (daughter) is leaving home to attend college this fall. Will my auto and homeowners insurance policies cover him (her) while at college?

Answer:

This is a great question, and one that our customers ask frequently.

When college students move from home to their home-away-from-home – a rented dorm or apartment – insurance issues can arise and should be addressed before they leave home.

One key question that arises in discussing these issues is whether the student is still considered a resident of your household. This is a legal question, but your homeowners and auto policies both contain provisions that apply the broadest coverage available in those policies to persons who are legally considered residents of your household.

It is generally accepted that students living away from home while attending college are residents of their parents’ household. Based on previous Texas court decisions, the real test is whether the absence of a person from the household is intended to be permanent or only temporary – whether there is physical absence coupled with intent not to return. This leaves a great deal of room for interpretation. There may be borderline cases that require you to think about alternatives. For example, it may be difficult to consider a 23-year-old graduate student living in an apartment year-round to be a resident of your household.

Sheaner Insurance Agency August 9th, 2015

Posted In: Personal Insurance